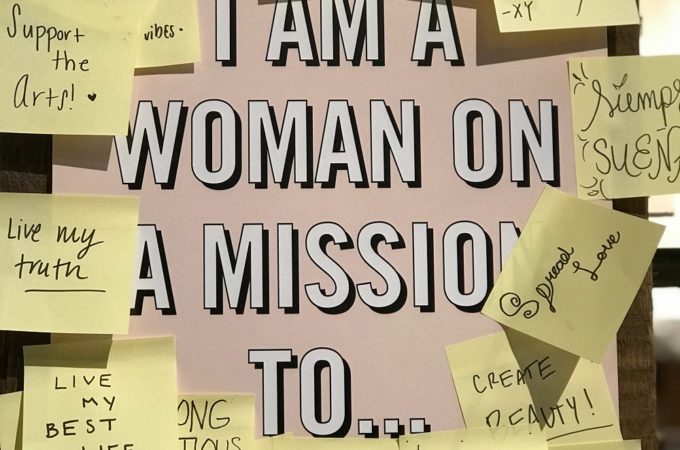

These Small Business Loans for Women Will Provide the Funds You Need

Nowadays, more and more women are starting their own businesses. According to the 2018 State of Women-Owned Businesses Report, the number of female entrepreneurs has increased by nearly 3,000% since 1972.

There are many reasons why that many women have decided to make a career change:

- to pursue their true passion

- to have more flexibility and spend more quality time with their family

- to advance more quickly

- to quench the thirst for success

These are all great motivators that can pave the way to a successful business.

Unfortunately, sometimes the inner drive isn’t simply enough.

One of the most common problems businesswomen face is not having sufficient financial funds to start or grow their entrepreneurial stories. As Guidant Financial states, 35% of female small business owners report their greatest challenge is a lack of capital and cash flow.

Luckily, there are financial institutions that focus on supporting female entrepreneurs through business loans and grants for women. If you want to find one that best suits your needs, check out Camino Financial’s article “Top 20 Small Business Loans for Women”.

The best way to show how loans and grants can change lives is to show you some examples of female business owners who applied for some kind of business loans for women and managed to obtain them.

A grant gave her the energy she needed…

Kristen Moffatt is an active bike rider who couldn’t find healthy energy bars when she would go out for the day. One day, frustrated, she decided to skip her nutritious snack, but it turned out to be a bad decision: Kristen almost collapsed on the trail.

She decided to start making her own energy bars out of honey and other healthy ingredients. She started selling them to their bike-riding friends. Everybody loved them, so naturally, Kristen decided to name her product and start producing Wasatch Nectar.

However, she needed capital to invest in packaging for her product and in that way to scale her business. That’s why she applied for the Amber Grant. Not only did Katrin receive a monthly grant of $1,000, but she also got $10,000 year-end Amber Grant.

This money will help her fulfill her first large order for Wasatch Nectar Honey to Go Packets.

Thinking of business while exchanging clothes…

Jennifer Simons thought of a business idea while having dinner with a friend she had exchanged clothes with.

She adored her friend’s clothes, but unfortunately, both women were completely different sizes. She thought: “What would it be like to go through the closets of girls my size and rent the clothes I like?”

Jennifer founded Dressmate, a platform that allows women to rent out clothes to each other.

One of her main challenges was finding capital to grow her business. Therefore, she applied for Girlboss Foundation Grant that awards female entrepreneurs who demonstrate business acumen, creativity, and financial need.

Jennifer’s business met all the requirements, so she won the grant and received the necessary funds that she plans to invest in rebranding with the help of the creative agency and renovating the inside of her retail space.

Find the small business loan for women that best works for you…

Are you looking for funds to start your business and enter the entrepreneurial world?

Are you tired of pitching your business story to numerous investors or being rejected for small business loans by different banks?

Do you need capital to invest in marketing, production or other necessities to scale your company?

If so, do what Kristen and Jennifer did, apply to get a small business loan or grant. That way, you will provide funds needed for taking your business to the next level.

And remember the wise words of Oprah Winfrey:

“Think like a queen. A queen is not afraid to fail. Failure is another steppingstone to greatness.”

Recommended

-

Female Real Estate Investors P...July 18th, 2024

-

Home Maintenance Tips To Save ...July 3rd, 2024

-

Is Perfectionism Keeping You F...June 20th, 2024

-

FIVE MONTHS FROM TODAY ~ SAVE ...May 23rd, 2024

-

Being Formidable!May 20th, 2024